Whitepaper32 pages

Private Equity Valuation for Lending

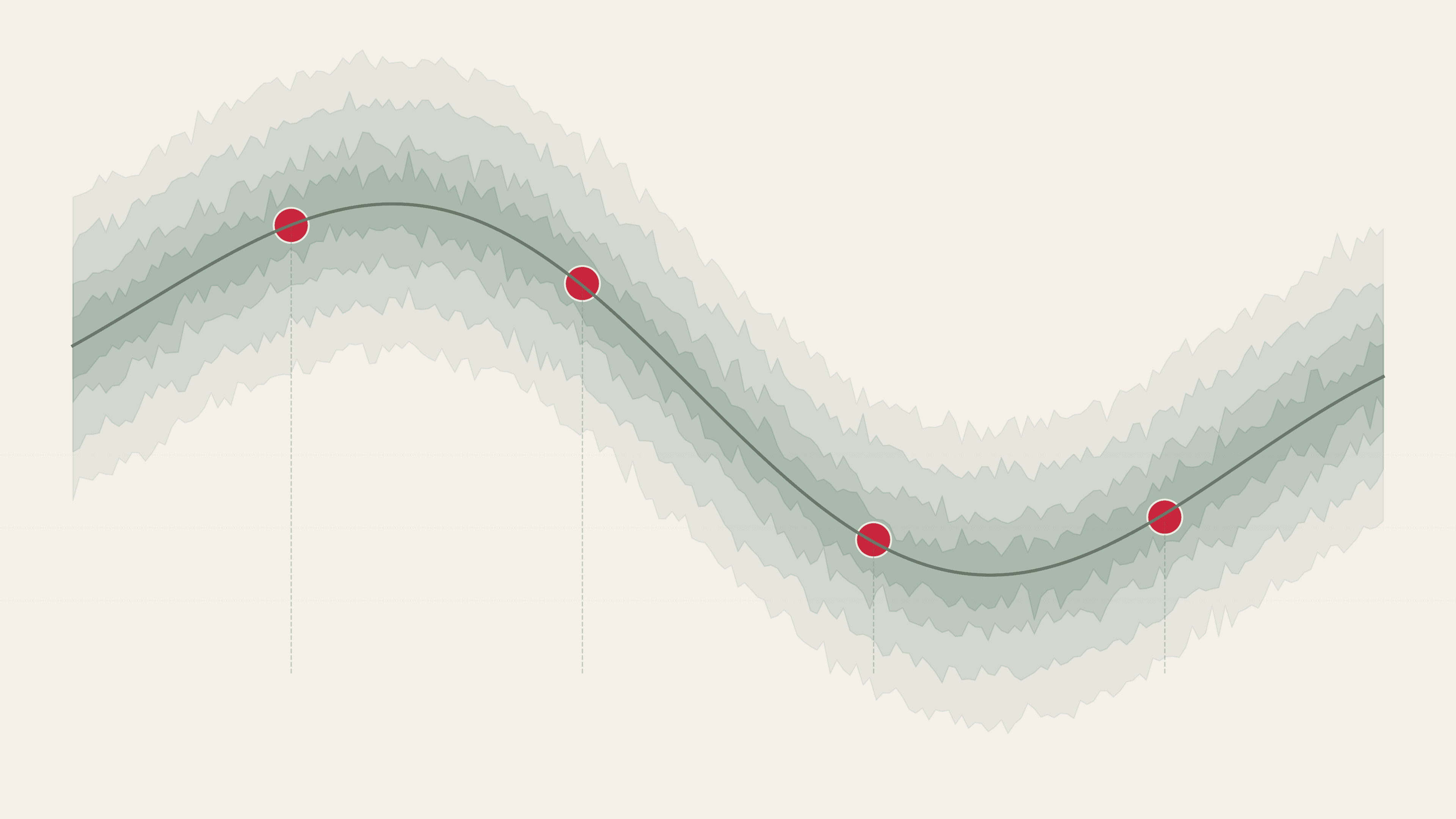

Private equity holdings represent one of the largest untapped collateral pools for financial institutions. This whitepaper examines the unique challenges of PE valuation for lending - from GP/LP structure complexities to capital call obligations to secondary market liquidity analysis - and presents a framework for establishing defensible loan-to-value ratios.

Key Topics

NAV-Based Valuation ModelsGP/LP Structure AnalysisCapital Call Impact AssessmentSecondary Market LiquidityConcentration Risk Factors

Full content requires registration

Request this whitepaper to receive the complete PDF with detailed analysis, implementation guides, and actionable frameworks.

Ready to explore alternative asset lending?

Schedule a consultation to learn how Aaim can help your institution implement the strategies outlined in this whitepaper.

Schedule consultation